How Much Is Disney Worth: A Look At The Magic's Real Value Today

Have you ever stopped to wonder just how big Disney really is? You know, the company behind those beloved characters, the theme parks that create so many memories, and all those movies we grew up with, and still enjoy? It's a pretty big question, so to speak, when you consider all the different parts of this entertainment giant. We often think of Disney as just fun and games, but there's a serious business side to it all, and understanding its true financial standing can be quite fascinating, you know.

When folks ask, "how much is Disney worth," they're usually curious about its overall financial muscle. It's not just about how many dollars it has in the bank, but rather the total value of everything it owns, all its different operations, and what investors think it could earn in the future. This kind of value, which is pretty significant, can change a lot depending on market conditions, new projects, or even how many people are visiting the parks or signing up for streaming services, basically.

So, we're going to take a peek behind the curtain, if you will, and explore what truly makes Disney such a valuable name in the world. We'll look at the various parts that contribute to its grand total, from its storied film studios to its sprawling resorts, and even its newer ventures in the digital space. It's a pretty big picture, and honestly, it shows just how much influence this company has on entertainment and culture, too it's almost.

Table of Contents

- Understanding Disney's Market Value

- What Makes Disney So Valuable?

- Recent Trends and Financial Health

- How Is Disney's Worth Calculated?

- The Impact of Global Events

- The Future Outlook for Disney

- Frequently Asked Questions

- What This All Means for You

Understanding Disney's Market Value

When people talk about "how much Disney is worth," they are often referring to its market capitalization. This figure, you know, is basically the total value of all of a company's shares of stock that are out there in the market. It's like taking the current price of one share and multiplying it by the total number of shares available. As of early [Current Month, Year], Disney's market value typically sits in the hundreds of billions of dollars, a truly substantial amount, that is. This number moves up and down every day with the stock market, so it's a bit like a living, breathing thing.

This market value isn't just a random number; it reflects what investors believe the company is worth right now, and what they expect it to be worth in the future. It takes into account all of Disney's assets, its earnings, and its potential for growth. For instance, if Disney announces a very popular new movie or opens a new theme park attraction, you might see that market value go up, pretty much. Conversely, if there are some unexpected challenges, it could dip a little, too it's almost.

It's important to remember that this market value is a snapshot in time. It's a large amount, to be sure, but it's always changing. For a company as vast and varied as Disney, with so many different income streams, this figure really shows the collective confidence (or lack thereof) that investors have in its continued success. It's a pretty good indicator, honestly, of how the financial world sees the magic kingdom.

What Makes Disney So Valuable?

So, what exactly contributes to such a significant financial standing? Disney isn't just one thing; it's a collection of many powerful businesses that work together. Think of it like a huge, intricate machine, where each part adds to the overall power. We're talking about a lot of different elements, you know, that come together to create this immense value. Each piece brings in a substantial amount of revenue, which adds up to a truly large degree of financial strength.

Parks, Experiences and Products

This segment is perhaps what most people think of first when they hear "Disney." It includes the world-famous theme parks like Disneyland and Walt Disney World, along with international parks in places like Tokyo, Paris, Hong Kong, and Shanghai. These places, you know, draw millions of visitors each year, generating a huge amount of income from tickets, food, merchandise, and resort stays. It's a massive operation, honestly, and a cornerstone of Disney's appeal.

Beyond the parks, this part of the business also covers the Disney Cruise Line, which is pretty popular, and Adventures by Disney, offering guided trips around the globe. Then there's the consumer products division, which handles all the toys, clothing, books, and other items featuring Disney characters. This segment alone brings in a great amount of money, which is quite something, as a matter of fact, when you consider how many different items are sold worldwide.

Media and Entertainment Distribution

This is where Disney's storytelling heart truly beats. It includes the iconic Walt Disney Pictures, Pixar, Marvel Studios, Lucasfilm (think Star Wars!), and 20th Century Studios. These studios consistently produce blockbuster movies that bring in a lot of money at the box office, which is a big deal. They also generate income from home video sales, licensing, and syndication, you know, when their movies and shows are shown on other networks.

This segment also covers Disney's television networks, such as ABC, Disney Channel, FX, and National Geographic. These channels, basically, earn revenue from advertising and from fees paid by cable and satellite providers. It's a very diverse portfolio, actually, that reaches millions of homes around the world, contributing a rather large amount to the company's overall financial health.

Direct-to-Consumer Streaming

In recent years, Disney has put a great amount of focus on its streaming services. This includes Disney+, Hulu, and ESPN+. These platforms, you know, are designed to reach audiences directly in their homes, offering a vast library of content for a monthly fee. Disney+ alone has grown incredibly fast, attracting millions of subscribers globally, which is pretty impressive.

While these services sometimes require a lot of investment to create new shows and movies, they represent a significant part of Disney's future strategy. They provide a steady stream of recurring revenue, which is pretty important for a company looking to grow. This shift towards direct-to-consumer content is a major reason why Disney continues to hold such a substantial value, honestly, in the modern entertainment world.

Recent Trends and Financial Health

Like any big company, Disney faces its share of ups and downs. Lately, there's been a lot of talk about the streaming business and how profitable it can be. While Disney+ has gained a huge amount of subscribers, making it a very strong player, the company has also been working to make these services more profitable, which is a bit of a challenge sometimes. This involves adjusting prices and figuring out the best mix of new shows and movies, you know.

The theme parks, on the other hand, have generally seen a strong return after recent global events. People are really eager to visit, which means good revenue from tickets and spending inside the parks. This part of the business, actually, continues to be a very stable and profitable engine for Disney, bringing in a great amount of money, as a matter of fact.

Also, the traditional TV networks are seeing changes as more people cut the cord and switch to streaming. Disney is adapting to this, of course, by putting more of its content on its own streaming platforms. It's a big shift, and it shows how the company is always looking to the future to maintain its value, pretty much. Learn more about on our site for more on how large companies adapt.

How Is Disney's Worth Calculated?

Calculating how much Disney is worth isn't just about looking at its market capitalization. Financial experts also consider other key factors. They look at the company's total assets, which include everything it owns – from the land its parks sit on to its intellectual property like Mickey Mouse. These assets represent a truly great amount of value, you know, that Disney holds.

They also examine Disney's revenue, which is the total money it brings in from all its operations before expenses. And then there's net income, which is the profit left over after all costs are paid. These numbers, basically, give a clearer picture of how well the company is performing financially. A company that consistently generates a large amount of profit is generally seen as more valuable, as you might expect.

Analysts also consider Disney's brand value. The Disney name itself, you know, carries immense recognition and trust worldwide. This intangible asset, while not easily measured in dollars, contributes a great deal to its overall worth. It allows Disney to charge premium prices and attract a loyal customer base, which is pretty powerful, honestly. It's a bit like having a golden ticket in the entertainment world.

The Impact of Global Events

Global events, as we've seen, can have a very significant impact on a company as large and globally connected as Disney. When travel is restricted, for example, the theme parks and cruise lines feel the pinch. When film productions are delayed, the movie release schedule gets affected, too it's almost. These kinds of events can certainly influence the company's immediate financial performance and, in turn, its market value.

However, Disney has shown a remarkable ability to adapt. During challenging times, they've leaned into their streaming services, offering entertainment directly to homes when people couldn't go out. This flexibility, you know, helps to mitigate some of the risks associated with global shifts. It's a testament to the company's long history and its capacity to weather storms, honestly, proving its resilience and ensuring its value remains substantial.

The Future Outlook for Disney

Looking ahead, Disney's future value will likely depend on several key areas. Continued growth in its streaming services is pretty important, especially as they work towards consistent profitability. New content, both for movies and streaming shows, will keep audiences engaged and subscribing, which is a big part of the plan. They need to keep creating stories that people really want to see, you know.

The theme parks are also expected to remain a strong contributor, with new attractions and experiences continually drawing visitors. International expansion, too, could play a role in increasing Disney's reach and revenue. The company is always looking for new ways to bring its magic to more people around the globe, basically. It's a very forward-looking company, and that helps maintain its great amount of financial strength.

Innovation in technology, such as virtual reality or new forms of interactive entertainment, could also open up new avenues for growth and add to Disney's overall worth. The company has a long history of embracing new technologies to tell stories, so that's something to watch for, honestly. It’s a pretty exciting time for entertainment, and Disney is certainly a major player in that story, as a matter of fact.

Frequently Asked Questions

How much revenue does Disney generate annually?

Disney generates a truly great amount of revenue each year, typically tens of billions of dollars. This figure, you know, comes from all its different business segments combined, including parks, movies, television, and streaming services. The exact amount changes year by year, depending on how well each part of the business performs, but it's always a very large sum, honestly.

What are Disney's most profitable segments?

Historically, the Parks, Experiences and Products segment has been a very strong profit driver for Disney, bringing in a huge amount of money. The Media and Entertainment Distribution segment, which includes film studios and TV networks, also contributes a lot. While streaming services are a major focus for growth, they are still working towards consistent, substantial profitability, you know, after significant initial investments.

Is Disney's stock a good investment?

Whether Disney's stock is a good investment depends on many factors and individual financial goals, basically. It's a widely held stock, and its value can fluctuate with market conditions and company performance. Many people see it as a long-term holding due to the strength of its brand and diverse businesses. It's always a good idea to do your own research or talk to a financial advisor before making any investment choices, honestly, as that is pretty important.

What This All Means for You

So, when we talk about "how much is Disney worth," we're really talking about a company that has built an immense and varied empire. Its value is not just a number on a stock ticker; it represents decades of storytelling, innovation, and connecting with people around the globe. It's a truly significant amount, to be sure, reflecting the power of its brand and its ability to adapt.

For fans, this financial strength means Disney has the resources to keep creating new movies, build exciting theme park attractions, and expand its streaming content. For anyone interested in the business world, Disney offers a fascinating case study in how a legacy company can evolve and remain relevant in a rapidly changing landscape. It’s a pretty compelling story, actually, of enduring value and influence.

Understanding Disney's financial standing gives us a fuller picture of its impact, not just as an entertainment provider, but as a major economic force. It's a company that continues to shape culture and bring joy to millions, and its worth reflects that profound reach. You can find more details about how large entertainment companies operate by linking to this page , which might give you a broader perspective on their business models, you know.

Is Disney+ Worth Getting and Worth the Money?

What a $1,000 investment in Disney 10 years ago would be worth now

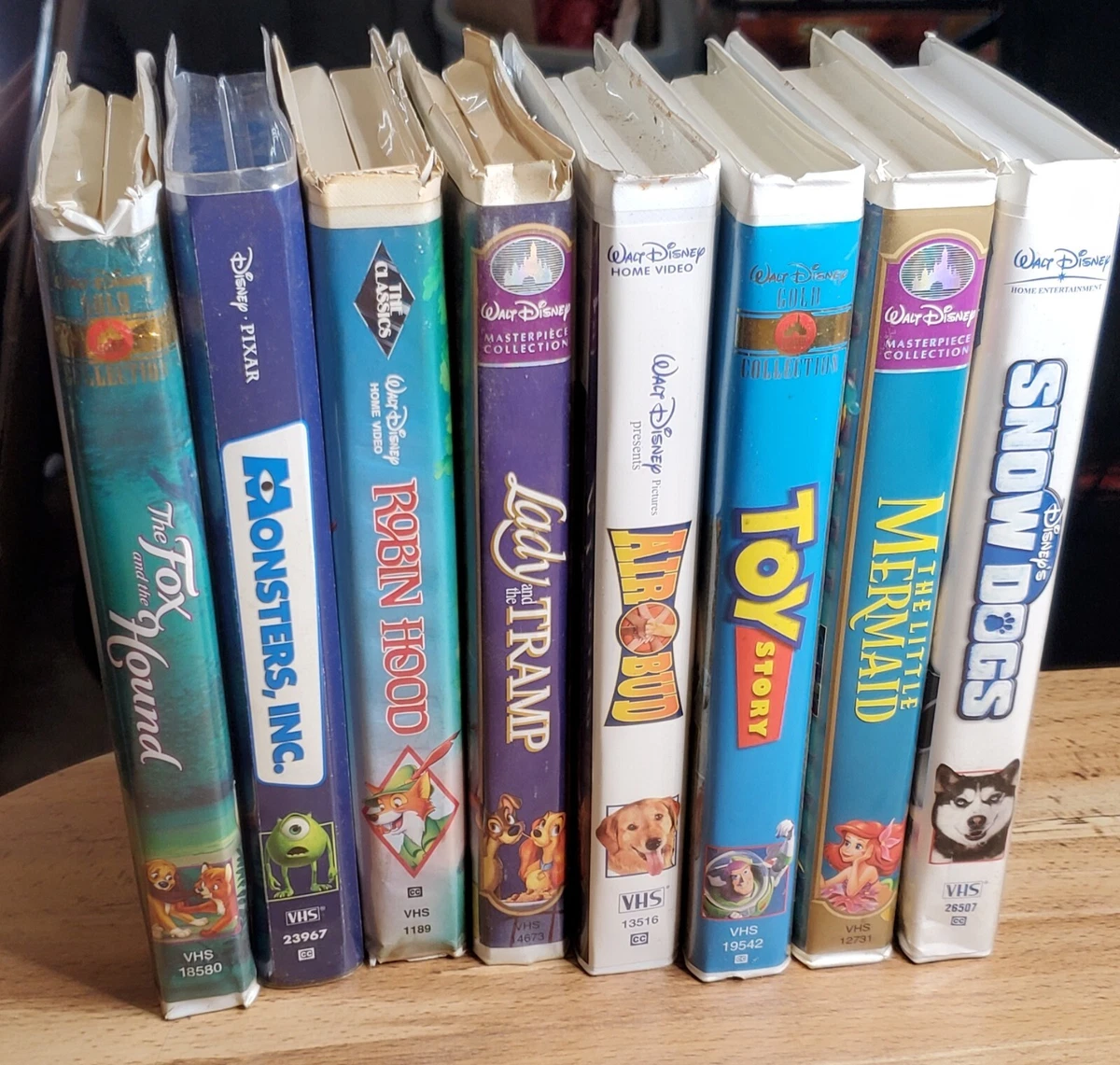

Are Disney VHS Tapes Worth Anything? The Most Valuable, 45% OFF